We were first to report the ongoing Paypal issue with Indian customers. Few days ago Paypal updated their customers about the situation informing that Reserve Bank Of India (RBI) has blocked these transactions citing import/export laws, despite being the information being pretty clear about the need of Importer Exporter Code (IEC) needed only if you are an exporter (see quote below) blogs started posting information that Indian users need to apply for IEC code via Ministry of Commerce and Industry to withdraw any money from Paypal in future.

We were first to report the ongoing Paypal issue with Indian customers. Few days ago Paypal updated their customers about the situation informing that Reserve Bank Of India (RBI) has blocked these transactions citing import/export laws, despite being the information being pretty clear about the need of Importer Exporter Code (IEC) needed only if you are an exporter (see quote below) blogs started posting information that Indian users need to apply for IEC code via Ministry of Commerce and Industry to withdraw any money from Paypal in future.

Misinterpreted part of PayPal's information update :

However, if you are an exporter, you will continue to be able to use the PayPal service for payments of goods and services. In fact, with the changes we are making to our system, PayPal is now set to be a more powerful engine for exporters in India. With purpose codes for export transactions and FIRCs (Foreign Inward Remittance Certificates), you should now be able to get the export related benefits you seek.

However, to put an end to all the confusion Paypal has now posted an update on their blog clarifying that users wont need the Importer Exporter Code (IEC) if they do not export goods but will simply require to quote a newly introduced "purpose code" which allows banks to furnish information required by the Reserve Bank of India to identify the nature of the cross border transaction. Withdrawals to Indian bank accounts will resume from 3rd March 2010 and you can find the appropriate "purpose code" in the table at the end of the post.

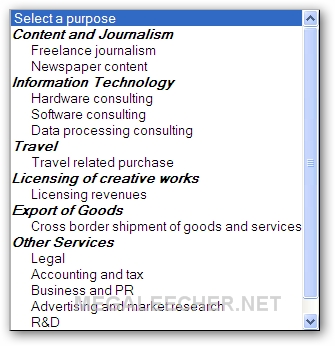

Paypal purpose code to identify nature of business :

| Code | Category | Description | Who should be using it |

| P0101 / P0104 | Export of Goods | Value of export bills negotiated / purchased/discounted etc. (covered under GR/PP/SOFTEX/EC copy of shipping bills etc.) | eBay merchants, jewelers, sellers of collectibles and other such products through eBay and your own websites / catalogues globally.

Please note: Cross border shipment of goods and services for which you file GR / PP / SOFTEX / EC forms only should be processed with this code. Use P101 if Deutsche Bank is your banker and P0104 if you bank with any other bank If you have any questions, please check with your bank to help you with the same. |

| P0301 | Travel , Hospitality and Tours | Purchases towards travel (Includes purchases of foreign TCs, currency notes etc over the counter, by hotels, hospitals, Emporiums, Educational institutions etc. as well as amount received by TT/SWIFT transfers or debit to Non-Resident account). | Online Travel Agents, Airlines, Railways, Buses, Taxicab Services, Hotels, B&Bs and other travel / tourism related sales through PayPal |

| P0801

P0802 P0803 |

Information Technology | Computer Information Services. Hardware / Software / Data Processing consultancy/implementation | If you are an independent / freelance coder / hardware consultant or data processing service provider, or a small business providing such services for websites globally, please use these codes.

For all IT related consulting services where you know you do not need to file a SOFTEX form, please use the appropriate code. 801 for hardware consulting, 802 for software consulting and 803 for data management and processing consulting services |

| P0805

P0806 |

Content and Journalism | News Agency and Subscription services | If you are a freelance journalist / blogger / news aggregator please use this purpose code for withdrawals.

If you are a newspaper or an online news aggregator for websites overseas, please use the appropriate code from these two. 805 if you a freelance journalist, and 806 if you are a newspaper / aggregator |

| P0902 | Licensing of creative works | Receipts for use, through licensing arrangements, of produced originals or prototypes (such as manuscripts and films) | Artists, designers, other creative service providers where the principal revenue mode is license fees, please use this code.

If you produce creative works which you license out for entities overseas, licensing revenues may be classified under this purpose code |

| P1004 | Other services | Legal Services | If you are providing outsourced law related services |

| P1005 | Accounting, auditing, book keeping and tax consulting services | For accounting consulting and accounting services | |

| P1006 | Business and management consultancy and public relations services | Management / brand consulting and management services can be exported with this purpose code | |

| P1007 | Advertising, trade fair, market research and public opinion polling services | Marketing/ brand consulting / logo design / event management services can be exported with this purpose code | |

| P1008 | Research & Development services | If you are an outsourced research and development services provider based in India, receipts can be inwarded through this purpose code | |

| P1009 | Architectural, engineering and other technical services | Any other technical services such as eTutoring, education and other services you render over the internet via web conferencing tools or similar channels, please use this code for your withdrawals |

Detailed information and FAQ's about this newly introduced system are available at Paypal blog here.

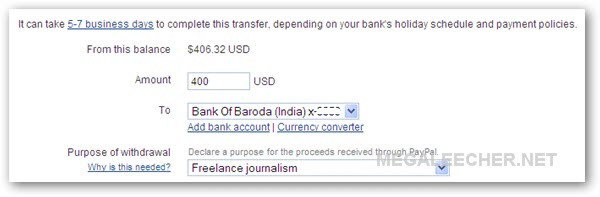

UPDATE : The purpose code system for Paypal withdrawals to Indian banks is now live, here are the screenshots :

Comments

Thanks

At last, we are going to have our payments in our banks. Thanks for letting us know Megaleecher.

Odesk payment to Paypal?

I want to know one more thing...how can I get my payment from odesk to paypal now? Has anybody sorted this issue as well or its still hanging out there? I have done some work on gift website for a client and my payment is stuck in odesk...

Can you tell me which purpose code I should use IF

Hi.. As you may be knowing that there are many ways of earning over the internet. And I have been using a site called XYZ to earn a small extra money. I know that the earning potential of that site is so high that if one can do well there then its not an Everest task to earn some thousands a month. And so If I were to choose PayPal for withdrawals then which Purpose code should I use? I am unable to decide which one to choose because I do not understand which categories these PTC's come under.

Add new comment